https://www.afr.com/personal-fin ... ins-20181112-h17tue

Westpac's Bank of Melbourne hikes discounts by 130bp to revive loans and rebuild margins

Duncan Hughes AFR

Westpac Group's Bank of Melbourne is set to offer mortgage discounts of more than 130 basis points in an aggressive marketing push to boost flagging demand from new borrowers.

The discounts are more than double those recently announced by CBA, the nation's largest lender and primary rival.

Bank of Melbourne is the first in the group to test the market with the discounts – but mortgage brokers expect Westpac and its other brands, BankSA and St George Bank, will quickly follow if business improves.

Its new policy is targeting rival lenders, such as NAB, which claim to have turned away from aggressive discounting in a bid to rebuild relationships with existing borrowers following bruising revelations in the royal commission.

Westpac, the nation's second largest lender, is set to unveil even bigger discounts for borrowers that have deposits of up to 40 per cent, with smaller deposits receiving lower discounts.

The bank's move comes as auction clearance rates slump and demand for investor and owner-occupier loans continue to weaken because of tighter screening of applications, rising costs and falling demand.

It recently rocked the property sector by announcing increases to standard variable rates on the eve of spring sales, traditionally the busiest time of the year for real estate sales.

The rate rises were quickly replicated by most of the nation's largest lenders, despite the Reserve Bank of Australia holding the cash rate steady.

NAB, which claimed it was holding standard variable rates to rebuild borrower confidence, has since been cutting discounts – or effectively increasing rates – for new borrowers.

Chief executive Andrew Thorburn said it has stopped chasing new business with aggressive discounts and will focus on rewarding loyal customers.

First-time buyers up for grabs

Home loan demand in September reveals some of the weakest housing demand in more than four years, according to the latest government statistics.

But lower prices, less pressure on buyers, more choice and greater opportunities to negotiate are attracting more first-time home buyers into the market, who are also receiving state government incentives, such as lower stamp duty, in some states.

Lenders are encouraging new borrowers by allowing for "Bank of Mum and Dad" financing deals, which allow the parents of borrowers to contribute to deposits, support repayments or underwrite the loans with their own homes or savings

A credit crunch created by tough macroprudential controls and deep-dive assessment of borrowers capacity to service loans are delaying – or declining – many loan applications.

Lenders, who need rising net interest margins to boost profits, are competing aggressively for first-time buyers offset losses in others, particularly interest-only investors.

The new Bank of Melbourne offer is targeting borrowers in its no-frills Advantage Package.

A discount of 130 basis points will be available for new loans, loan increases or for borrowers switching from other lenders.

Borrowers with a loan to value ratio of 80 per cent, or less, will be eligible for additional discounts.

For example, borrowers with deposits of between 20 per cent and 40 per cent are being offered another 5 basis points rising to 10 basis points for 40 per cent mortgage.

Bank of Melbourne is the first to offer the new rates but other banks within the group are expected to follow.

"It's part of our ongoing commitment to helping more Victorians into their own homes," according to the bank, which describes the cuts as "important changes to our pricing structure".

CBA, HSBC, ING and Westpac have recently decreased rates, increased discounts, or reduced loan fees for new borrowers in a bid to stimulate demand.

CBA, the nation's largest lender, is increasing discounts of up to 50 basis points on variable mortgage rates in a bid to attract more first-time buyers and existing borrowers seeking to refinance.

评论

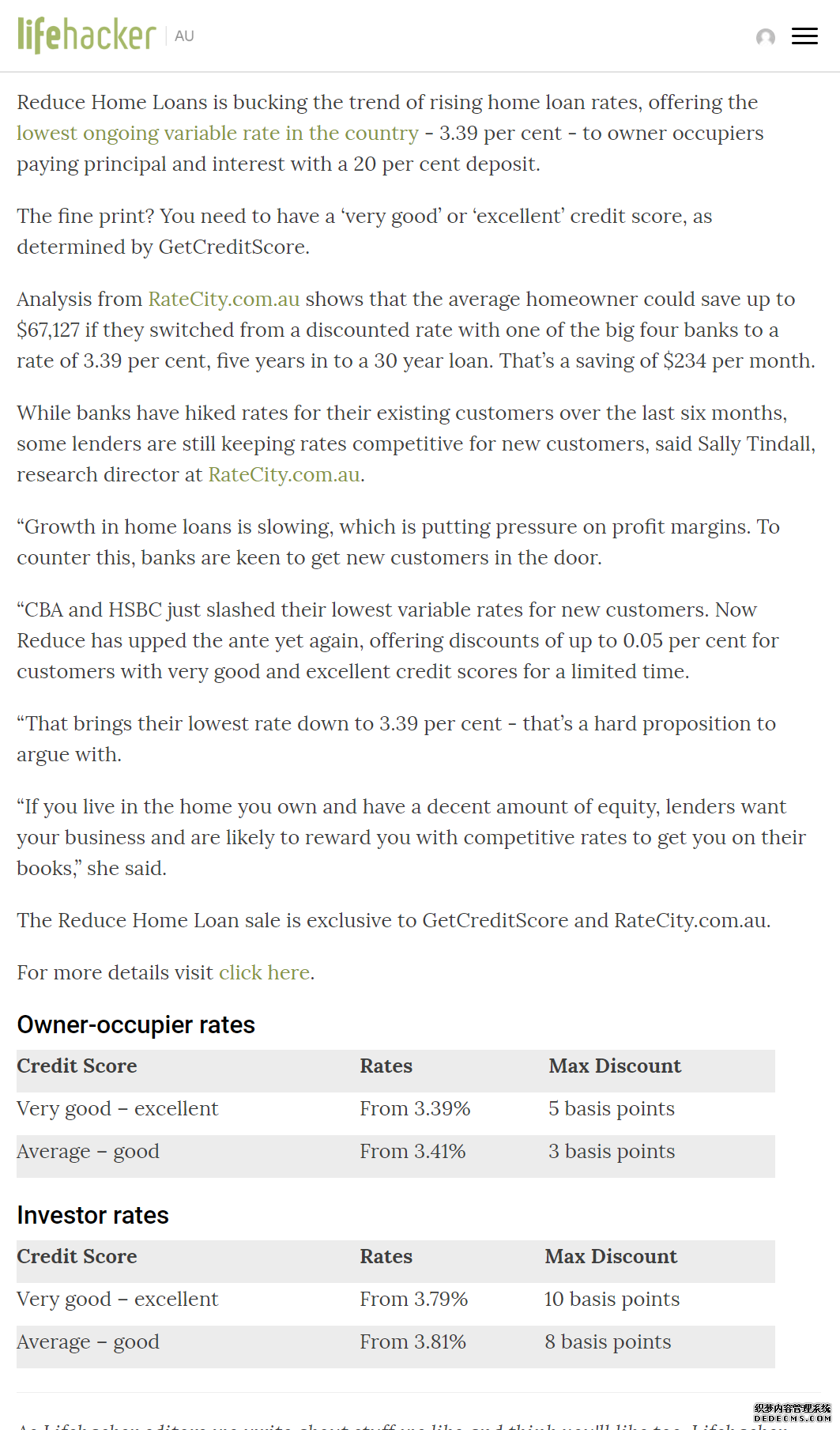

https://www.lifehacker.com.au/20 ... -sale-starts-today/

评论

这可能是个趋势,等澳洲全面信用数据报告体系推广完善之后,澳洲可能就会像美国一样,信用好的利率好,信用差的利率差。

目前过渡期可能像西太这样,首付多风险低的贷款人的利率折扣高。

评论

这是自然会有的趋势,在目前的氛围下

泾渭分明

评论

评论

哇,自住房利息3.39%,创造历史新低了。澳洲银行在学美国了,给信用分高的人低利息,好趋势!我的信用分800分,不知道够不够呢。

评论

感觉现在风向变了。要降息了

评论

刚查了下,954分。但是明年2月固定才到期,这个明天之前就要申请,这是错过了把。

评论

关注

评论

看来以后4以下的贷款常见,要3以下才算是好的了

评论

Oh my God. Time to refinance my loans.

评论

关键是评估标准变得更严,贷的更少

评论

请问怎么查信用分啊?谢谢。

评论

就是牺牲投机客来补正常自住房。

评论

你的信用分咋那么高呢?总分才1000吧?

评论

应该够的。1800万有信用记录的澳洲人里,

very good是726到832,你信用分属于第二梯队,20%到40%那一档。

excellent是833到1200,信用最好的前20%.

评论

投资房利息只有3.79%,也是创造历史新低了。

评论

那就是说信用分726以上就能拿到最好的利息,这个要求不算高。

评论

好事。我也900多,看来可以refinance了

评论

关键refinance又要你提供一堆文件

评论

居然900多,可惜贷款都fix了

评论

bank west,st george不包括在裡面吧?雖然是旗下公司

评论

第一次知道自己信用分竟然有944。

评论

哪裡可以查自己的信用分數?

评论

https://www.getcreditscore.com.au

评论

我咋局3的这个新颖5评分好dogey,完全收集个人信息嘛,有这么多信息我都能去开张信用卡了

评论

请问如何看自己的信用评级?

评论

这个网站安全吗?要填那么详细的个人信息。

评论

credit savvy使用体验好一点

评论

会不会是这样几步

1.收紧贷款审批

2 等待房市下跌

3.利用房市下跌趋势,降低利率

4.再次放松贷款,利率保持不变

5 ....

澳洲中文论坛热点

- 悉尼部份城铁将封闭一年,华人区受影响!只能乘巴士(组图)

- 据《逐日电讯报》报导,从明年年中开始,因为从Bankstown和Sydenham的城铁将因Metro South West革新名目而

- 联邦政客们具有多少房产?

- 据本月早些时分报导,绿党副首领、参议员Mehreen Faruqi已获准在Port Macquarie联系其房产并建造三栋投资联