房价崩盘造成业主进入负资产领域

Adam Huges从来没有想到,在珀斯远郊购买一个普通的3睡房独立屋有一天会造成他进入财政困难,无法还贷。

他是个全职机械师,有2个孩子,他2015年在Byford购买了这个33万6千元的独立屋。

三年后的今天,这栋房屋的估值是28万。

更糟糕的是,Hughes先生与伴侣的关系破裂,离婚花了很多钱。

如果他现在卖房,那他就只会剩下5万6千元债务,所以他被迫继续持有。但是随着账单y也来越多,他已经无法跟上还贷的步伐。

“这就像雪球一样。刚开始只是落后了一点点,而6个月后你会发现所有的账单都还不上了。”

“我已经尽可能地坚持了,然而我还是到了现在的境地。”

“我给银行打了电话,告诉他们我需要一些帮助。”

- “这是一个持续性的、永远都在的负担”

Hughes先生只是越来越多的负资产澳大利亚人中的一个-负资产的意思就是对银行的欠款超过了房屋的价格。

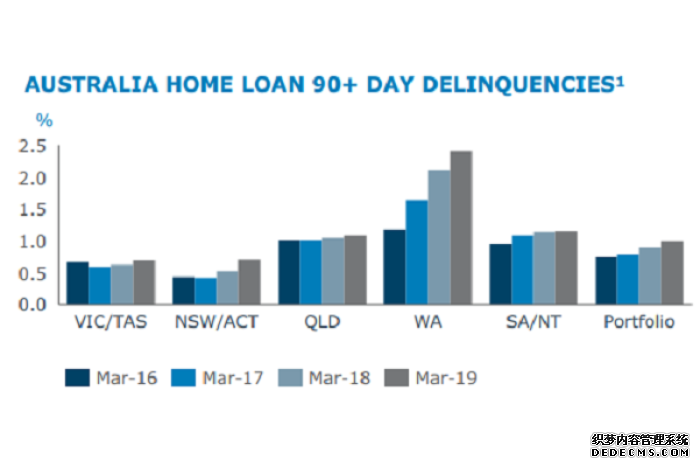

澳大利亚储备银行4月份说:“负资产率最高的地方在西澳、北领地和昆士兰。这些地方随着矿业活动的降低,出现了大幅度的房屋价格下降。”

”大约60%的负资产房贷在西澳或者北领地。“

Digital Finance Analytics的一份新的调查报告显示,西澳有大约11万6千个家庭处于负资产中。

但是随着新州以及维多利亚房地产繁荣的过去,这些州的负资产数字可能很快上升。

摩根斯坦利分析师Richard Wiles说,负资产的压力随着房价下跌而上升。

“假设其他条件不变,我们估计如果房价再下跌5%,那就会有大约4.5%的房屋进入负资产”

“如果房价下跌到10%,那负资产率就是7.5%,如果房价下跌20%,那负资产率会达到18%。”

对很多贷款者,这并不会成为问题-只要他们能够按时还贷,并撑过房价下跌周期,并等到价格回暖。

但是财务咨询服务商Anglicare说,哪怕家庭收入出现很小或者临时的下降,就会造成一些家庭无法按时还贷。

“很多家庭面临巨大压力,他们知道如果出一点问题-例如有人出现健康问题】失业或者工作小时数被消减,那他们就真的麻烦了。”

“对于这些人来说,房贷是一个持续性的、永远都在的负担”

- 房屋被回收数目上升

西澳法律援助机构为那些面临放贷机构收房的人们提供咨询服务。

“从1月份以来,我们大约每个月帮助60个人,这是我们去年数字的翻倍。”民事法律总监Justin Stevenson说。

从西澳高等法庭获得的数字显示,本财年以来,放贷机构已经有943个回收房屋的申请。

如果速度不变,今年的数字会超过去年的1234个。

Stevenson先生说:“这是一个问题,而这个问题不会消失”

他提到,很多贷款人在只还利息期过后,每个月的月供更高了。

Stevenson先生说,那些面临还贷困难的人应该尽早寻求帮助。

“不要上法庭,因为这只会让银行的诉讼费用加到你的债务上。”

- 尽早寻求帮助

在电力公司把他引荐给一位财务咨询师以前,Hughes先生并不知道他可以得到免费的专业帮助。

“在那以前,我只是独自挣扎”

咨询师帮助他跟银行协商了一个还款计划,并且帮他管理了其他欠款。

“刚开始只是一个很小的账单,但如果你在它变成滚雪球以前就寻求帮助,事情会简单很多。”

Anglicare的Mark Glasson说,在金融业皇家调查委员会以后,放贷机构更有弹性了。

“我觉得那是因为他们被要求更有弹性。”

“但是我觉得,处于银行的利益,他们应该更仔细的检查那些贷款对象。”

Huges先生说,他对这些帮助很感激,但他的财政状况任然很艰难。

“特别是你不知道从哪里挣钱的时候。”他说。

“孩子们的食物-这并不经常发生-很明显我很幸运,有一个全职工作,相对还不错,但任然非常困难。”

原文:

https://www.abc.net.au/news/2019 ... ive-equity/11200468

评论

又拿珀斯撒气,你懂的

评论

所以更证明了买房必须在悉尼和墨尔本

评论

可以去抄底了,有些人会这么觉得

评论

估计过几天 一样的事情就发生在悉尼和墨尔本人民的身上了

评论

除了悉尼墨尔本其他城市房价没有底

评论

舆论在给政府压力

评论

33万的房子自己还不起贷款,恐怕需要从自身找原因了

评论

真是便宜才33万

评论

33万在悉尼很多好区只能买一个车位。

评论

Wa是澳洲先锋指标,别的地方先别笑

评论

珀斯房价确实是起不来,我住在珀斯,我住这条街上就2套for sale,其中一套快一年了,还没卖掉。。珀斯的房子,谁买谁倒霉。。。我当时买是为了自住,没有办法。投资就算了

评论

可不是么 让我们悉尼人咋活~~~

评论

在澳洲,男人结婚生子要谨慎,一旦离婚,倾家荡产,扒两层皮。

评论

我很赞同

评论

刘司令强势归来

评论

所以这个明显是离婚被扫地出门造成的,还请刘司令列出些正常的例子。

评论

关键是离婚赔了很多钱,这个故事告诉我们不要随便离婚,解决办法就是再找一个

评论

这得带了多少款啊!!

评论

才这点贷款就扛不住了?

评论

可以试试起诉银行当初为啥贷那么多。

评论

看意思让银行放松贷款条件不太可能

评论

我来给空军送点弹药把

https://www.theaustralian.com.au ... cdf10b1849fa8031ac1

The banking regulator wants lenders to hold higher levels of capital for riskier home loans, such as interest only and investor mortgages, as part of a package of sweeping reforms. In a statement today, the Australian Prudential Regulation Authority is taking a more granular ...

今天银行股有一波下跌

评论

APRA全文

https://www.apra.gov.au/media-ce ... i-capital-framework

12 June 2019

The Australian Prudential Regulation Authority (APRA) has released its response to the first round of consultation on proposed changes to the capital framework for authorised deposit-taking institutions (ADIs).

The package of proposed changes, first released in February last year, flows from the finalised Basel III reforms, as well as the Financial System Inquiry recommendation for the capital ratios of Australian ADIs to be ’unquestionably strong’.

ADIs that already meet the ‘unquestionably strong’ capital targets that APRA announced in July 2017 should not need to raise additional capital to meet these new measures. Rather, the measures aim to reinforce the safety and stability of the ADI sector by better aligning capital requirements with underlying risk, especially with regards to residential mortgage lending.

APRA received 18 industry submissions to the proposed revisions, and today released a Response Paper, as well as drafts of three updated prudential standards: APS 112 Capital Adequacy: Standardised Approach to Credit Risk; the residential mortgages extract of APS 113 Capital Adequacy: Internal Ratings-based Approach to Credit Risk; and APS 115 Capital Adequacy: Standardised Measurement Approach to Operational Risk.

The Response Paper details revised capital requirements for residential mortgages, credit risk and operational risk requirements under the standardised approaches, as well as a simplified capital framework for small, less complex ADIs. Other measures proposed in the February 2018 Discussion Paper, as well as improvements to the transparency, comparability and flexibility of the ADI capital framework, will be consulted on in a subsequent response paper due to be released in the second half of 2019.

After taking into account both industry feedback and the findings of a quantitative impact study, APRA is proposing to revise some of its initial proposals, including:

for residential mortgages, some narrowing in the capital difference that applies to lower risk owner-occupied, principal-and-interest mortgages and all other mortgages;

more granular risk weight buckets and the recognition of additional types of collateral for SME lending, as recommended by the Productivity Commission in its report on Competition in the Financial System; and

lower risk weights for credit cards and personal loans secured by vehicles.

The latest proposals do not, at this stage, make any change to the Level 1 risk weight for ADIs’ equity investments in subsidiary ADIs. This issue has been raised by stakeholders in response to proposed changes to the capital adequacy framework in New Zealand. APRA has been actively engaging with the Reserve Bank of New Zealand on this issue, and any change to the current approach will be consulted on as part of APRA’s review of Prudential Standard APS 111 Capital Adequacy: Measurement of Capital later this year.

APRA’s consultation on the revisions to the ADI capital framework is a multi-year project. APRA expects to conduct one further round of consultation on the draft prudential standards for credit risk prior to their finalisation. It is intended that they will come into effect from 1 January 2022, in line with the Basel Committee on Banking Supervision’s internationally agreed implementation date. An exception is the operational risk capital proposals for ADIs that currently use advanced models: APRA is proposing these new requirements be implemented from the earlier date of 1 January 2021.

APRA Chair Wayne Byres said: “In setting out these latest proposals, APRA has sought to balance its primary objectives of implementing the Basel III reforms and ‘unquestionably strong’ capital ratios with a range of important secondary objectives. These objectives include targeting the structural concentration in residential mortgages in the Australian banking system, and ensuring an appropriate competitive outcome between different approaches to measuring capital adequacy.

“With regard to the impact of risk weights on competition in the mortgage market, APRA has previously made changes that mean any differential in overall capital requirements is already fairly minimal. APRA does not intend that the changes in this package of proposals should materially change that calibration, and will use the consultation process and quantitative impact study to ensure that is achieved.

“It is also important to note that the proposals announced today will not require ADIs to hold any capital additional beyond the targets already announced in relation to the unquestionably strong benchmarks, nor do we expect to see any material impact on the availability of credit for borrowers,” Mr Byres said.

评论

慢了点啊:

http://www..com.au/bbs/f ... &extra=page%3D1

评论

现在买的话才28万,请看全文章

评论

评论

全职工作负担不起33万的贷款?估计那两孩子每周5天CC吧

评论

33万贷款,4%年利息来算等于13200/年

就算是P&I也不过再加个3000左右,一个礼拜330刀

去麦当劳打工也能赚到吧......

澳洲中文论坛热点

- 悉尼部份城铁将封闭一年,华人区受影响!只能乘巴士(组图)

- 据《逐日电讯报》报导,从明年年中开始,因为从Bankstown和Sydenham的城铁将因Metro South West革新名目而

- 联邦政客们具有多少房产?

- 据本月早些时分报导,绿党副首领、参议员Mehreen Faruqi已获准在Port Macquarie联系其房产并建造三栋投资联