在新西兰

拿了pr,每年待不到184天就不可以买房,可是可以如果超过184天就被算作税务居民。国内收入上税吗

永久回头签证是以当天的日期往回推一年算184天,那税务居民是按财年算吗?

已经买了房子,但是后来住不到184天,要卖房吗,还是说如果把房子放在信托下面就没事了。

不知道这算不算问题,胡乱表达一下

评论

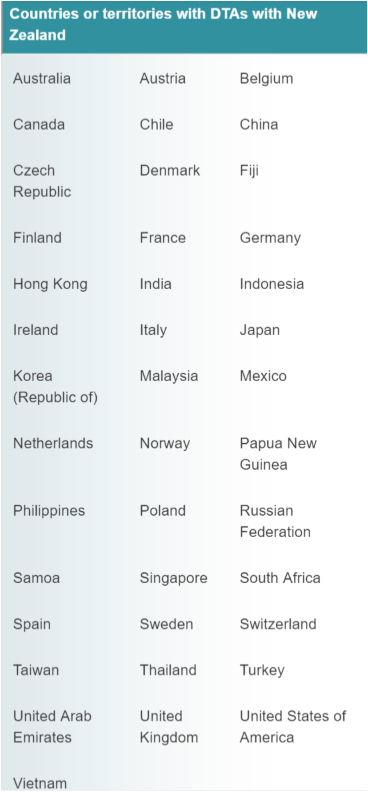

http://www.ird.govt.nz/internati ... reements-index.html

评论

不会重新上税,是补差额,需要补的才交。在国内多交了的,NZ不退税。会计那里都有软件自动计算的。

评论

那还是做nz税务居民好一些,至少有章可循,谢谢

评论

if you are deemed to be NZ tax resident, you pay nz tax rates for overseas income, less the amount you pay tax in china, the balance you pay to NZ IRD.

It is voluntary declare, they will find that out if they see discrepancies. Eg, you bought $1 million house, you pay $3000 a month for interest mortgage. You don't pay much tax in NZ (say just $2000 a year).

Then IRD will ask you where did you get your $3000 a month interest payment, you said from overseas income. Then they said, you are already a NZ tax resident, you should be paying your NZ tax from your overseas income. That is where a can of worm was opened.

If you are in NZ for 184 day, you are deemed to be NZ tax resident and will be liable to pay NZ tax for your global income irrespective of double tax agreement (DTA).

Overseas investment amendment bill is a trap. haha..

评论

所以说全款买房就没事了 对吧 *

评论

All interest earned overseas,

Dividend

Shares earning,

Rental incomes from overseas

Pension from overseas

Incomes from business (overseas)

Payments (consulting) from overseas

IRD will look at those things (above) and say your life style do not match what you declared in NZ tax (eg, if you just pay $2000 tax a year, and drive a ferrari, and putting assets in your children names, wife name and mistress name etc)

"you look like you have not been declaring your overseas incomes" said IRD. So, IRD back dates the calculation on the number of years you are in NZ ( as tax resident) and calculate the amount of tax you need to pay for your overseas income.

评论

问题是你怎么有钱全款买房? 如果在这里只有5万年薪, 怎么能全款买100万的房子?如果大部分钱是国内过来的, 那这国内来的钱是不是你的收入?是的话, 就要在NZ交税。

评论

Another interesting case is one rich man actually avoiding living 184 days in NZ but have all assets under wife, children names.

But IRD caught him under " Permanent place and abode". IRD said "You have not lived here for 184 days a year, but you make NZ your permanent place and abode ( by being a PR), use nz address for your correspondence, applied for ird nos, have bank accounts, your children, wife are all here, all these linked you to make yourself an ordinary resident of nz"

So, 184 days does not count in these circumstances.

That rich man was taxed $5 million for back taxes for his overseas income. The family had since left the country.

In short, 184 days is just a guide, IRD has another knife of using "permanent place and abode test" to catch........ haha.

评论

在这种时候,避税离岸公司就有意义了

不过操作貌似挺复杂,除非你真的很有钱

评论

如果是父母送的钱,应该就没问题了吧?

评论

no gift duty since 2011 Oct

Lol

评论

国内卖了房子来这里全款买房,然后抵押买了几套投资房,topup出来钱买宝石结(不买法拉利),利息刚好等于租金,自己做个割草生意糊口,就没事了吧

评论

不一定

评论

haha... if it is a gift by parents for son to buy a house and stay with newly met girl friend in NZ?

Both of them (son & gf) moved in, married, split, the house becomes a matrimonial home, and subject to 1/2 share claim.

Parents lost the gifting money.

haha.... yes, correct no gift duty in NZ. No need to pay ird, but end up taken away by someone else.

评论

The gifting happened in China, parents are in china. China might have gift taxes.

Tax & Death are certain. LOL

评论

如果是本地人去别的国家工作,房子留下出租了。那么在别的国家的工资要在NZ报税吗?如果那边税率低,莫非还要补上NZ税率?

评论

Rent still pay NZ tax. Ie filing IRD 3

If working overseas permanently, ie leaving nz for more than 185 days and working in Dubai, just pay Dubai tax.

Few factors IRD will determine if you are still NZ tax resident (not black and white):

- The purpose and length of any return trips to NZ while you’re on overseas job

- Your family, business and employment ties in NZ

- Whether you maintain assets, such as a family home, in NZ while you’re working overseas

- If you’re living in temporary accommodation while on overseas job and your other social arrangements.

评论

是啊,这样感觉合理啊。

评论

拿到pr后的4年之内有豁免期,也就是说四年之内海外收入在nz不用交税。听ird的人讲座说的。

评论

http://www.ird.govt.nz/income-ta ... pt-foreign-inc.html

[Temporary tax exemption on foreign income for new migrants and returning New Zealanders

yes, you can only claim it once in a life time. However, there are exceptions.

Foreign income that is not tax-exempt for first 4 years.

From IRD website : "These types of foreign income are not tax exempt in New Zealand:

Employment income from overseas employment performed while living in New Zealand.

Business income relating to services performed offshore.

If you have any of these types of income, you must declare them on your Individual tax return (IR3) from the date of your arrival in New Zealand "

评论

it's complicated...haha, fortunately I don't have to face these problems

评论

with all these taxes, 回国 is a good move.

评论

can they gift the money to the child, then put the property in a family trust? does that solve the problem of the in-laws claiming half the property when they break up?

评论

好复杂。那要是卖了国内的房子,然后蚂蚁搬家把钱转到NZ,这些钱需要在NZ 补缴税款吗?

评论

i hope this world is so ideal and we can put things in boxes..... haha.

Children run around in the lawn,

Parents holding hands,

sheep, and cows just straw along..........

评论

Looks like a good idea.